Debt recovery is a process to recover / seek payment of debt from individuals, businesses or companies in the event of refusal or delays in payment of debts. In Malaysia, it is not uncommon for creditors to resort to legal action when all other attempts to elicit payment from a recalcitrant debtor have failed. This article sets out some frequently asked questions as well as some practical advice about the legal process in Malaysia for debt recovery.

For creditors

Do I need to issue a letter of demand before initiating legal proceedings to recover the debt?

It is not a mandatory requirement to issue a letter of demand to the debtor before you commence legal proceedings against the debtor. Having said that, it is always prudent to issue a letter to demand to your debtor as it serves as a reasonable notice to your debtor that legal action will be taken, should the debtor fail, neglect or refuse to comply with the demand.

A letter of demand also assists in building up evidence of indebtedness.

Is there a minimum amount owed before I can commence legal proceedings against the debtor?

No, there is no specified minimum amount owed before a legal action can be taken. However, the amount of money intended to be claimed by you will determine the court which you are to file your action in:

| Amount of Claim | Types of Courts |

| Up to RM5,000.00 | Magistrates Court / Small Claim Procedure (by individuals only) |

| Up to RM100,000.00 | Magistrates Court |

| Up to RM1,000,000.00 | Sessions Court |

| Above RM1,000,000.00 | High Court |

I can’t locate the debtor anymore, can I still take legal action to recover my money?

Yes. Even if you can’t locate the debtor anymore, you may still commence legal proceedings and obtain judgment against the debtor. In situation like this, upon pronouncement of judgment against the debtor, you may apply to the Court to enforce the judgment against assets of the debtor. You may even apply to the Court to order the debtor to be summoned before the Court for an examination of the debtor’s financial status. If the debtor still refuses to appear in Court, he/she can be arrested and imprisoned.

Is there a time limit to commence legal action against the debtor?

In any matters relating to any forms of contract, the limitation period for commencing legal action is generally 6 years from the date on which the cause of action accrued i.e. the date of the money is due for payment.

However, once you have obtained judgment against the debtor but the debtor still fails or refuses to pay up in accordance with the judgment, you may enforce the judgment within 12 years from the date of judgment (Leave of court may be required if more than 6 years have lapsed from the date of judgment)

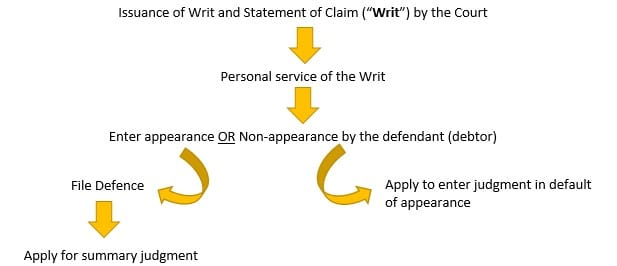

Can I sue the debtor without having to go through trial?

Yes, it is possible to obtain a judgment without going through a trial, for example where the debtor does not enter appearance to the suit, or where he fails to file a defence.

In certain straight forwarded cases (eg: where there are not many disputes as to facts), you may apply to court for summary judgment. The Court will determine your claim based on affidavit and documentary evidence. There is no trial and no witnesses are required to testify in a summary judgment proceeding.

Court process for debt recovery (without trial)

How long does the process take to obtain a judgment (without a trial) against the debtor?

From the issuance of a letter of demand to obtaining of a judgment in default of appearance against the debtor, it usually takes about 3 months.

However, if the claim is disputed i.e. defence is filed, the process could take about 4 to 5 months to obtain a judgment summarily.

Please note that the above are just estimates only as timelines will vary depending on various factors such as the Court’s schedule.

What if the debtor is already a bankrupt or an insolvent company?

You may file a Proof of Debt in the Insolvency Department with regard to your debt. Secured creditors like banks would have priority over unsecured creditors in relation to the distribution of bankrupt/insolvent company’s assets.

I don’t want a mere paper judgment, what can I do to enforce the judgment?

There are a few ways to enforce a judgment in Malaysia as listed below. Factors such as costs, time, types of asset owned by the debtor, etc. are to be taken into account to decide which of the below is the most effective way to enforce a judgment.

- Judgment Debtor Summons

- Writ of Seizure and Sale

- Writ of Possessions of Immovable Property

- Writ of Delivery

- Garnishee Proceedings

- Charging Order

Many assume that bankruptcy and winding-up proceedings are the same as the above execution proceedings. In fact, they are actually fresh proceedings as they are governed by separate law and rules. The subject matter no longer focuses on the debt, but on the debtor himself. Also, in practical terms, a creditor seeking recovery of their debt should be mindful that bankruptcy and winding-up proceedings may not yield significant returns since usual trade creditors and judgment creditors will be unsecured creditors who rank below secured creditors in terms of priority.

For debtors

What should you do when you receive a letter of demand from your creditor?

You shall never ever disregard a letter of demand! Upon receiving such a letter, read through it and check the facts and figures stated therein. If you are disputing the amount demanded by your creditor, please reply by stating the correct figure within the stipulated time frame. On the other hand, if you do not wish to dispute the debt and are prepared to settle the sum, you should reply in writing to your creditor to make a reasonable settlement arrangement with your creditor. The most common arrangement is to propose an installment plan within your means. Bear in mind the creditor has no obligation to accept your installment plan, even if it is reasonable.

If you are not sure, always consult a lawyer before responding in writing since the way you respond could actually affect your defence if there are legal proceedings commenced against you.

If you know that someone is going to sue you – is it better to just evade or refuse service of the court papers?

No, you should never evade service of a Writ. When a Writ is served on you by personal service, A.R. registered post, registered post or even ordinary post (pursuant to the term of contract on how should a legal notice or demand served on either party), you must enter an appearance in court within 14 days after service of the Writ to answer the claims brought against you.

In the event you choose to evade service of a Writ, the Plaintiff (creditor) may apply to Court for an order of substituted service of the Writ, in which the Court would normally order the Plaintiff to advertise the Writ in local newspaper and/or post the same at a clear visible area of your last known address. You may not want substituted service to be effected since it is a form of public announcement that legal proceedings are being taken against you.

Once the above are duly complied by the Plaintiff, a judgment may be entered against you in your absence and you are still legally responsible to pay up your debt.

Do you need to appoint a lawyer to defend your case?

Technically, there is no hard-and-fast rule in law which states that you need a lawyer in court. It very much depends on your confidence and ability in defending yourself. However, since court proceedings involve technical legal aspects such as civil procedure, filing timelines and rules of evidence, you are generally advised to appoint a lawyer if there are court proceedings ongoing.

***

Have a question? Feel free to contact us.